Trade Finance Market Overview

Trade finance refers to the financial instruments and products used by companies to facilitate international trade and commerce. It includes activities such as lending, issuance of letters of credit, factoring, export credit, and insurance. The global trade finance market plays a critical role in bridging the gap between importers and exporters, helping mitigate risks and improve liquidity.

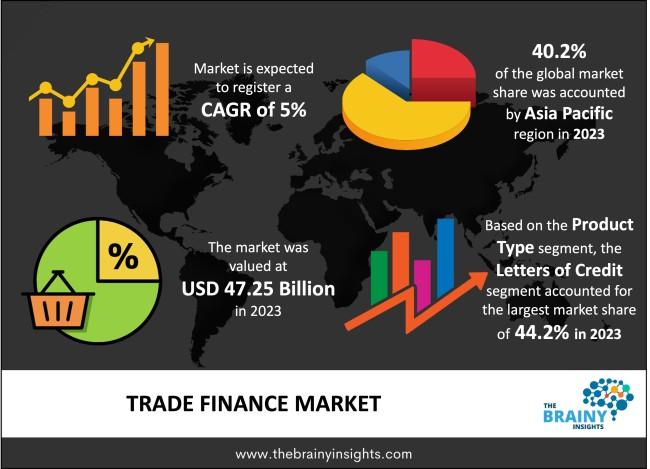

The global trade finance market was valued at USD 47.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5% from 2024 to 2033, reaching an estimated USD 76.97 billion by the end of the forecast period.

Market Dynamics

Drivers:

- Growth in international trade volumes

- Increasing demand from SMEs for trade finance solutions

- Digital transformation and adoption of blockchain and AI

- Government support and favorable trade policies

Restraints:

- High risk of non-payment and fraud

- Complex compliance and regulatory requirements

- Limited access for small businesses in emerging economies

Opportunities:

- Fintech innovations in trade finance

- Expansion in emerging markets (Asia-Pacific, Africa)

- Supply chain finance integration

Regional Analysis

- North America: Strong banking infrastructure and growing adoption of digital trade finance platforms.

- Europe: Established trade finance ecosystem, particularly in Germany, the UK, and France.

- Asia-Pacific: Fastest-growing region driven by China and India’s robust export/import activity.

- Middle East & Africa: Increasing trade flows and government efforts to digitize finance.

- Latin America: Moderate growth with rising cross-border trade and fintech penetration.

Segmental Analysis

By Product Type:

- Letters of Credit

- Supply Chain Financing

- Factoring

- Export Credit

- Insurance

By Provider:

- Banks

- Trade Finance Houses

- Fintech Companies

By End-Use Industry:

- Manufacturing

- Energy & Utilities

- Healthcare

- Agriculture

- Technology

List of Key Players

- Citigroup Inc.

- HSBC Holdings plc

- JPMorgan Chase & Co.

- BNP Paribas

- Standard Chartered

- Mitsubishi UFJ Financial Group

- Euler Hermes

- Santander Bank

- Commerzbank AG

- Trade Finance Global

Key Trends

- Increasing use of blockchain for secure, transparent trade transactions.

- Growth of ESG-linked trade finance.

- Digital documentation and smart contracts adoption.

- Rise of alternative lenders and digital trade finance platforms.

- Focus on sustainability and compliance in trade processes.

Conclusion

The trade finance market continues to evolve with the dual forces of globalization and digitization. While challenges such as regulatory complexity and SME access persist, technological advancements and increasing global trade offer promising growth opportunities. Industry stakeholders must embrace innovation and collaboration to remain competitive in this rapidly changing environment.

For Further Information: