Automotive Chip Market Overview

The automotive chip market is a rapidly evolving segment within the broader semiconductor industry, driven by growing demand for vehicle electrification, advanced driver assistance systems (ADAS), infotainment, and autonomous driving technologies. Automotive chips—covering microcontrollers (MCUs), sensors, processors, and power semiconductors—are essential for vehicle safety, connectivity, and efficiency.

The global market is witnessing robust growth due to increasing vehicle production and the integration of high-tech features in both electric and internal combustion engine (ICE) vehicles.

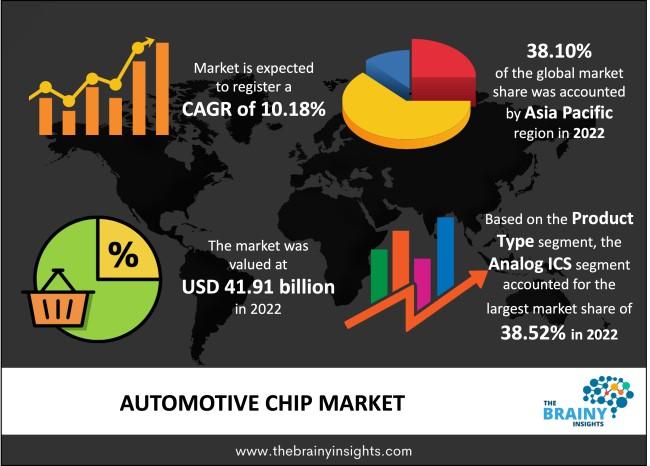

The global automotive chip market was valued at USD 41.91 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.18% from 2023 to 2032. By 2032, the market is expected to reach a value of USD 110.49 billion.

Market Dynamics

Drivers:

- Rise in Electric Vehicles (EVs): EVs require significantly more semiconductors per unit than conventional vehicles.

- Advancements in ADAS and Autonomous Driving: High-performance chips are needed for real-time data processing and safety features.

- Increased Demand for Connected Cars: Integration of 5G, IoT, and infotainment systems boost chip consumption.

- Government Regulations: Stricter emission and safety norms are pushing manufacturers to adopt electronic control systems.

Restraints:

- Global Chip Shortage: Supply chain disruptions continue to affect production.

- High Development Costs: Design and testing of automotive-grade chips are costly and time-consuming.

Opportunities:

- Growth in Emerging Markets: Rising automotive demand in countries like India, Brazil, and Southeast Asia.

- R&D in AI-based Chipsets: Opportunities in AI/ML-powered vehicle platforms.

Regional Analysis

- North America: Strong presence of EV manufacturers and tech giants investing in autonomous vehicles.

- Europe: Leading in automotive innovation with major OEMs like BMW, Volkswagen, and Mercedes pushing for greener and safer cars.

- Asia-Pacific: Largest automotive production hub with key players in China, Japan, and South Korea. Significant demand from both domestic and export markets.

- Latin America and MEA: Gradual adoption of automotive electronics, with Brazil and UAE leading investments in smart mobility.

Segmental Analysis

By Chip Type:

- Microcontrollers (MCUs)

- Analog ICs

- Power Semiconductors

- Logic ICs

- Sensors

By Application:

- Powertrain

- Safety

- Body Electronics

- Infotainment & Telematics

- ADAS & Autonomous Driving

By Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

List of Key Players

- NXP Semiconductors

- Infineon Technologies

- Texas Instruments

- Renesas Electronics

- STMicroelectronics

- ON Semiconductor

- Analog Devices

- Intel Corporation

- Qualcomm Technologies

- Robert Bosch GmbH

Key Trends

- Increasing use of system-on-chip (SoC) solutions.

- Growing adoption of SiC and GaN for power electronics.

- Integration of AI and machine learning in automotive chips.

- Emergence of software-defined vehicles (SDVs) requiring robust computing hardware.

- Development of over-the-air (OTA) update capability through onboard chips.

Request PDF Brochure: https://www.thebrainyinsights.com/enquiry/sample-request/12622

Conclusion

The automotive chip market is positioned for sustained growth, driven by transformative changes in the automotive sector including electrification, autonomy, and connectivity. Despite challenges like the chip shortage, long-term prospects remain strong due to accelerating R&D, evolving consumer preferences, and supportive regulatory environments.