Fintech Market Overview

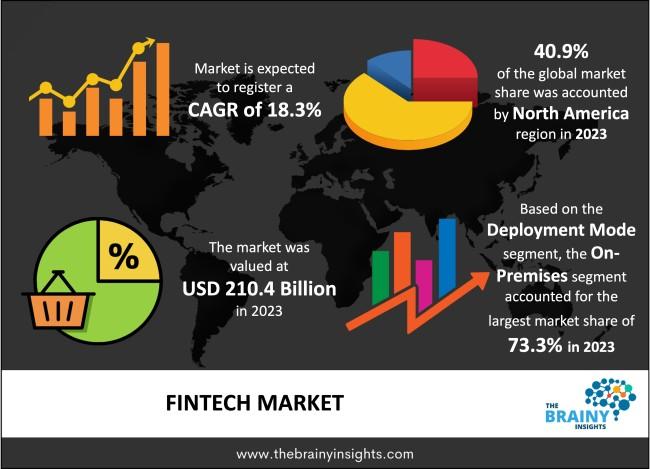

The global fintech market was valued at USD 210.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 18.3% from 2024 to 2033, reaching an estimated USD 1,129.52 billion by the end of the forecast period.

Market Dynamics

The fintech market has experienced exponential growth over the past decade, driven by the increasing digitization of financial services, rising smartphone penetration, and a growing preference for digital banking.

Key factors fueling the market include:

- Technological advancements (AI, blockchain, cloud computing)

- Changing consumer behavior favoring convenience and speed

- Regulatory support in the form of open banking and digital ID initiatives

- Rise in venture capital funding and fintech startups

- Cybersecurity threats and data privacy concerns as notable restraints

Regional Analysis

- North America: Leads the fintech market with strong infrastructure, tech adoption, and regulatory support.

- Europe: Growth driven by PSD2, open banking, and digital challenger banks.

- Asia-Pacific: Rapidly expanding due to high mobile usage, unbanked populations, and supportive government policies (e.g., India’s UPI).

- Latin America & Middle East: Emerging markets with increasing fintech adoption, especially in mobile payments and lending.

Segmental Analysis

- Payments (digital wallets, P2P, merchant services)

- Lending (peer-to-peer, BNPL, microloans)

- WealthTech (robo-advisors, digital investment platforms)

- InsurTech (AI-based underwriting, claims automation)

- RegTech (compliance automation, fraud detection)

- Blockchain & Cryptocurrency (trading, custody, DeFi)

List of Key Players

- PayPal Holdings Inc.

- Square, Inc. (Block)

- Stripe

- Ant Financial (Alipay)

- Adyen

- Robinhood

- Revolut

- SoFi Technologies

- Coinbase

- Plaid

Key Trends

- Embedded finance integrating financial services into non-financial platforms

- AI and machine learning in credit scoring and fraud detection

- Decentralized finance (DeFi) and blockchain innovation

- Buy Now Pay Later (BNPL) services growing rapidly

- Sustainable and ESG-focused fintech solutions

- Bank-fintech partnerships accelerating innovation and scale

Request PDF Brochure: https://www.thebrainyinsights.com/enquiry/sample-request/12704

Conclusion

The global fintech market is set to continue its rapid evolution, with innovation, regulatory developments, and customer expectations shaping its trajectory. Stakeholders must stay agile to leverage the opportunities presented by digital disruption while addressing associated challenges in security, regulation, and competition.