The Green Bonds Market: Financing a Sustainable Future

The green bonds market has emerged as a crucial tool in the global effort to combat climate change and promote sustainable development. Green bonds are fixed-income instruments specifically earmarked to raise funds for environmentally friendly projects, such as renewable energy, energy efficiency, clean transportation, sustainable agriculture, and climate adaptation.

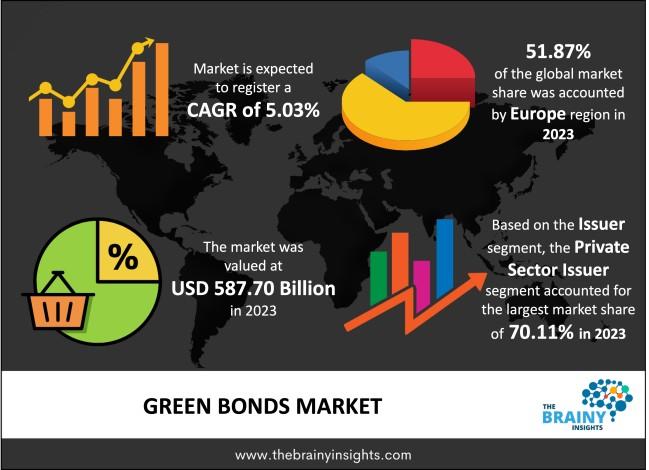

The global green bonds market was valued at USD 587.70 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.03% between 2024 and 2033, reaching an estimated USD 960.04 billion by 2033.

Growth and Trends

Since the first green bond was issued by the European Investment Bank in 2007, the market has experienced exponential growth. According to data from the Climate Bonds Initiative, green bond issuance surpassed $500 billion globally in 2023, with projections estimating continued expansion as more institutions align with environmental, social, and governance (ESG) goals.

Key Players

Governments, multilateral institutions (like the World Bank), and private corporations are active participants in this market. Sovereign green bonds issued by countries like France, Germany, and China have set benchmarks, while corporations such as Apple and Toyota have also launched significant green debt programs.

- HSBC Holdings plc

- Credit Agricole

- Citigroup Inc.

- Deutsche Bank AG

- JPMorgan Chase & Co.

- BofA Securities, Inc.

- Barclays plc

- TD Securities

- Morgan Stanley

Standards and Certification

To ensure transparency and prevent "greenwashing," frameworks like the Green Bond Principles (GBP) by the International Capital Market Association (ICMA) provide guidelines on use of proceeds, project evaluation, management of funds, and reporting. Additionally, third-party verifiers assess whether projects meet environmental objectives.

Challenges and Opportunities

While the green bond market is growing, challenges remain. These include inconsistent definitions of “green,” a lack of standardized reporting metrics, and concerns about actual environmental impact. However, with increasing regulatory support—such as the EU Green Bond Standard—and investor demand for sustainable finance, the market is poised for further maturation and integration into mainstream investment strategies.

Future Outlook

As climate-related risks become more material to investors and regulators, green bonds offer a compelling way to channel capital toward a low-carbon economy. Innovations like blue bonds, transition bonds, and sustainability-linked bonds are expanding the sustainable finance toolkit, signaling a robust future for the green debt market.

For Further Information: